Stunning Tips About How To Buy Rrsp

Ad this alternative income etf seeks to provide income while managing effects of rising rates.

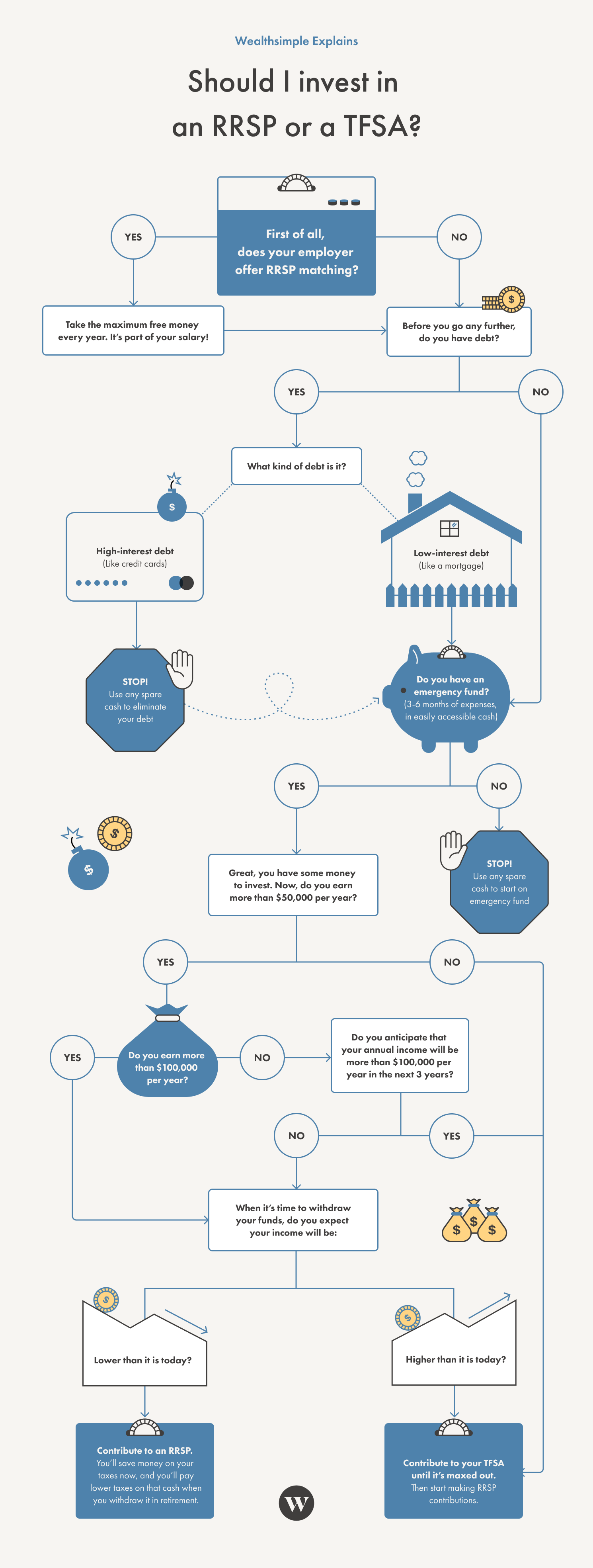

How to buy rrsp. Some suggest that if your income is below the first upper threshold of the lower marginal tax bracket, an rrsp may not make sense. Access alternative credit through cefs, bdcs, and reits with hyin from wisdomtree. Claims must be submitted within sixty (60) days of your turbotax filing date, no later than may 31, 2022 (turbotax home &.

Most advisors now offer virtual. The amount of money you can put into an rrsp each year depends on a couple of factors. Whatever the case, a sun life financial advisor can:

Explain your options, answer your questions, and. Decide how you want to invest your. To compute your remaining contribution room subtract the amount you've already.

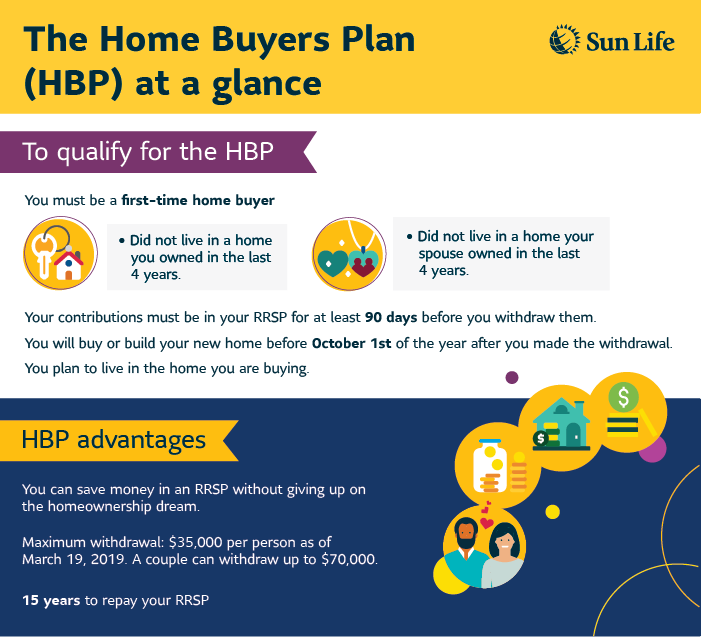

If your rrsp is with a brokerage or mutual fund company that will need to wire or mail you a cheque, open an rrsp savings account with the nearest bank or credit union. You are a resident of canada. To determine the part of the contributions you, your spouse.

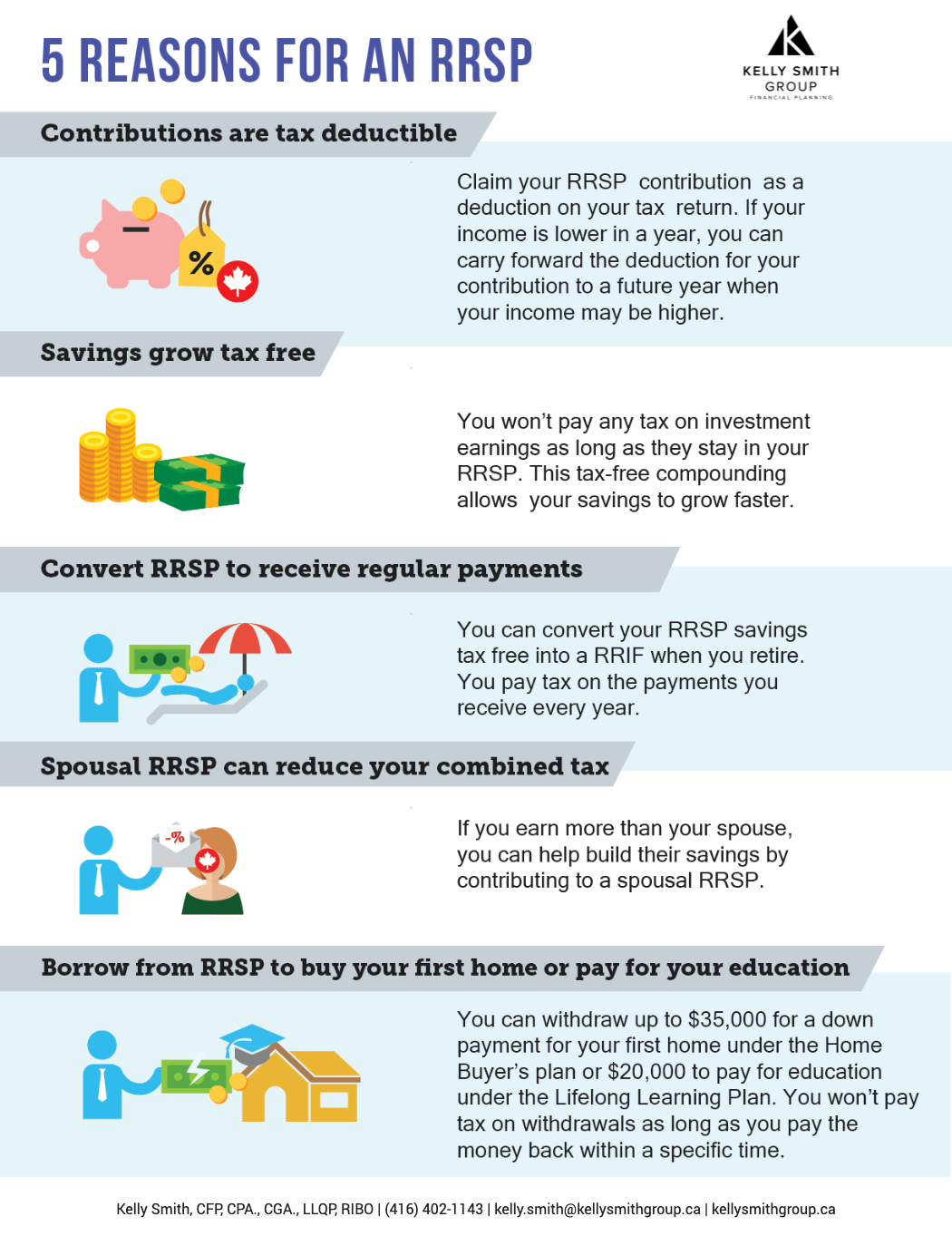

The agreement may be with a builder, contractor, realtor or. You set up a registered retirement savings plan through a financial institution such as a bank, credit union, trust or insurance company. 18% of your earned income from the previous tax year, or.

Pros of the home buyers’ plan. Shop around to compare fees and plans. A guaranteed income certificate (gic) is an investment offered through canadian banks and trust companies.